Analyzing Impact of COVID-19 on Europe Biotechnology Instrumentation Market

Evaluating Financial Stability During & Post Pandemic

We understand the intense effect of the coronavirus on numerous businesses across the globe, affecting the opportunities, marketing strategies, and pricing models, that are further affecting the growth of the businesses worldwide. We provide updated pointers in this economic pandemic to help the conglomerates to sustain in these uncertain and challenging times and ensure that they take affirmative business decisions. Know More

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2033 with Market Insights.

With the dip in global production, the GDP has contracted in 2022 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2033. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Introduction and Overviews

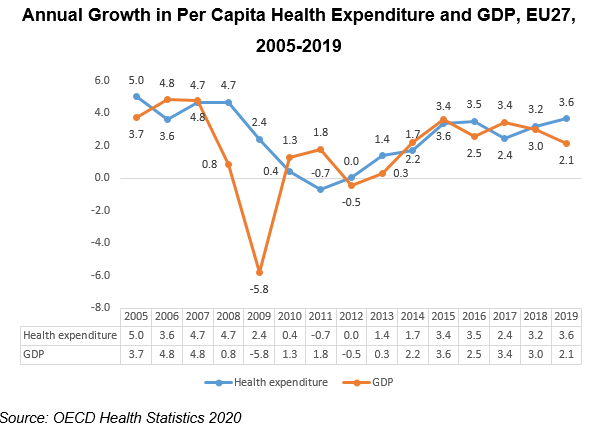

The Europe Biotechnology Instrumentation Market is projected to experience a modest CAGR during the forecast period, i.e., 2023-2033. One of the major factors anticipated to drive the growth of the market in the coming years is the surge in focus laid by the government of the region towards raising the expenditure on research and development in healthcare. Further, several structural changes brought into the healthcare system, which enables healthcare providers to focus on better productivity, is also projected to boost the market growth in the coming years. Moreover, rising focus of the players in enhancing the quality of their services is also expected to act as a major factor for the growth of the market during the forecast period. Over the past decade, the healthcare sector has been evolving and transforming itself at a rapid pace. This has been majorly led by the adoption of digital technologies being embraced amongst the players in the healthcare industry operating across the European region. Along with this, the changes observed in the methods used in diagnosis and treatment of patients is also helping to transform the healthcare sector.

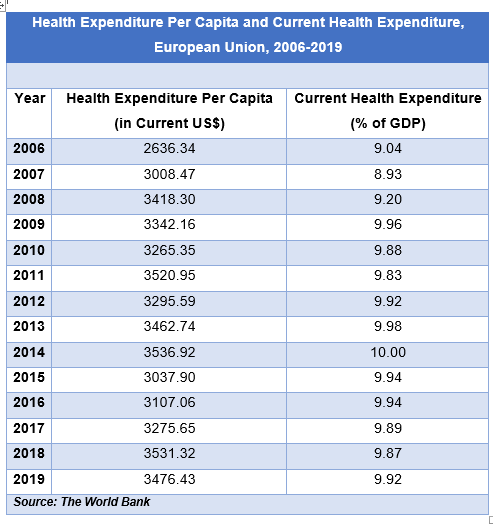

The domestic general health expenditure per capita by the government in the European Union (EU) reached USD 3414.58 (in current international $) in 2019, up from USD 1351.97 (in current international $) in the year 2000. Our study on the Europe Biotechnology Instrumentation market is driven by the surge in adoption of an exhaustive approach towards the industry analysis which comprises of the overall market size and revenue growth, along with the recent market developments. Besides this, the analysis also includes the growth drivers, market segmentation, opportunities and challenges that are expected to influence the market growth in the coming years. Additionally, the Europe Biotechnology Instrumentation market is estimated to attain notable absolute $ opportunity value by the end of 2033 as compared to the value achieved in 2022.

The study of the Europe Biotechnology Instrumentation market offers a detailed analysis that is associated with the growth of the market during the forecast period. The market research report also includes risk analysis of the market that majorly covers the demand and supply risk affecting the market growth, both in the historical years and the future years. In addition to this, the report also includes the existing and future market trends prevalent in the region. Moreover, the report also covers the study of the correlation and regression analysis for the determination of relation between independent and dependent variables.

Top Macro-Economic Indicators Impacting the Growth:

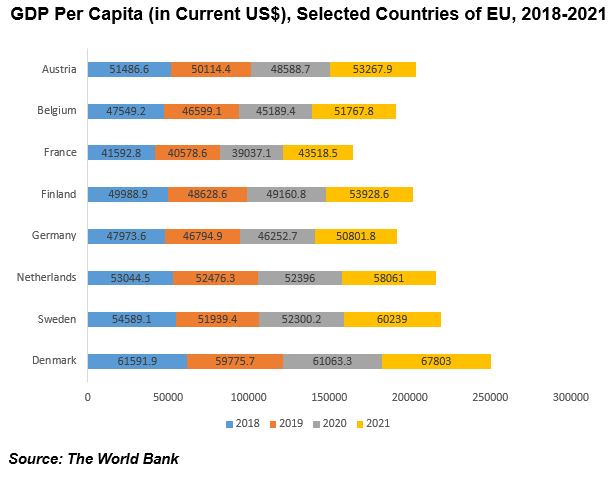

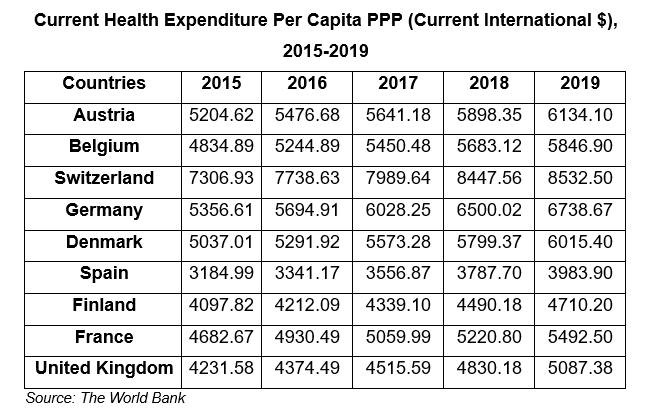

The region of Europe registered an increase in GDP per capita growth of 5.5 percent in 2021 from 2.7 percent registered in 2017 that was considered to be the highest since 2007. Countries belonging to the European Union (EU) such as France, Germany, Sweden and Denmark recorded a significant GDP per capita (in Current US$) that was hovering between USD 43518.5 and USD 67803 in the year 2021 with the level of GDP per capita in Denmark being the highest among the EU member states reaching USD 67803 (in Current US$) in 2021. Countries such as Sweden and Netherlands were placed second and third respectively in their order of GDP per capita by recording USD 60239 and USD 58061 respectively in 2021. About 9.92 percent of the GDP of the EU had been spent towards healthcare in 2019. Switzerland recorded a magnificent share of 11.29% of its GDP on health spending in the year 2019. On the other hand, countries such as Romania (5.74%) and Luxembourg (5.37%) recorded a lower share of health spending in GDP in 2019.

In the year 2019, it was estimated that the countries in the European Union devoted an average of 8.3% of their GDP to healthcare, a figure which was more or less unchanged since the year 2014. The spending on health in the region remained broadly in line with overall economic growth, while in the same year, one-fourth of the member states of EU spent at least 10% of their GDP on health in the same year. Amongst all the EU nations, Germany and France recorded the top two positions with 11.7% and 11.2% share respectively. On the other hand, the EU member states with the lowest shares of GDP allocated to healthcare were Latvia, Poland, Romania, and Luxembourg with 6.3%, 6.2%, 5.7%, and 5.4% respectively in the year 2019. Further, in that very year, Switzerland allocated the largest share of 12.1% of its GDP to health amongst the whole of Europe.

With health being most fundamental to living a quality life, as it affects the capacity of individuals to produce and consume goods and services, the life expectancy of males and females at the time of birth in the EU was 77.5 years and 83.2 years respectively in the year 2020. Moreover, infant mortality in the EU fell from 4.2 deaths per 1000 live births in 2009 to 3.3 deaths per 1000 live births in the year 2020. On the other hand, the member nations of the EU have been financing for health spending of their population by way of insurance that is compulsory by the governments belonging to the EU.

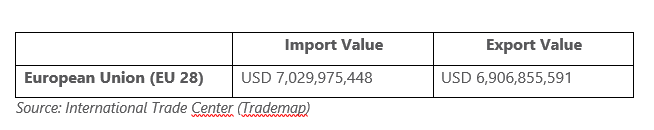

Export and Import Scenario:

Geographic Overview

The report includes a section on European region which is further segmented on a country/regional level including Germany, U.K., France, Italy, Spain, BENELUX, Netherlands, NORDIC, Poland, Hungary, Russia, Turkey, and Rest of Europe.

Competitive Landscape

A complete section on competitive landscape provides an understanding of the companies in current strategic report based upon various parameters which includes overview of the company, business strategy, major product offerings, key performance indicators, risk analysis, recent development, regional presence and SWOT analysis. There is a separate section which has been provided on the market share of key players in this market, as well as the competitive positioning of the players.

Key Topic Covered

- Market Size, Demand, Y-o-Y Growth Comparison

- Market Segmentation Analysis

- Market Segmentation Analysis by Geography

- Europe (Germany, France, UK, Spain, Italy, BENELUX, NORDIC, Russia, Poland, Turkey, Hungary, Rest of Europe)

- Absolute $ Opportunity

- Regional Average Pricing Analysis

- Demand and Supply Risk

- Regulatory Landscape

- Regression and Correlation Analysis

- Porters Five Force Model

- Market Dynamics

- Growth Drivers

- Demand Side Drivers

- Supply Side Drivers

- Economy Side Drivers

- Challenges

- Trends

- Opportunities

- Growth Drivers

- Macro-economic Indicators impacting the growth of the market

- Competitive Landscape

- Market Share of the companies

- Competitive Positioning of the companies

- Overview of the companies

- Key Product Offerings

- Business Strategies

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- SWOT Analysis

- Recent Developments

- Regional Presence

Major Target Audience for this report:

- Manufacturers of the product

- Suppliers of raw materials

- Distributors

- Strategic and management consulting firms

- Investors

- Investment banks

- Various regulatory and Government bodies

- Industrial Associations

- Research Organizations and institutes

- Organizations, alliances and forums related to this market

Crucial Questions Answered in this report:

- How the market is going to be impacted based upon the macroeconomic indicators?

- What are the various opportunities in Europe Biotechnology Instrumentation market?

- Which segment and which country has the fastest growth?

- Complete analysis of the competitive landscape

- Where the maximum opportunity lies in terms of further investments by region?

- Potential countries for investment

Scope for the Customization:

We are open for the customization of this report for our client.