Analyzing Impact of COVID-19 on Construction Waste Processing Market

Evaluating Financial Stability During & Post Pandemic

We understand the intense effect of the coronavirus on numerous businesses across the globe, affecting the opportunities, marketing strategies, and pricing models, that are further affecting the growth of the businesses worldwide. We provide updated pointers in this economic pandemic to help the conglomerates to sustain in these uncertain and challenging times and ensure that they take affirmative business decisions. Know More

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2033 with Market Insights.

With the dip in global production, the GDP has contracted in 2022 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2033. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Introduction and Overviews

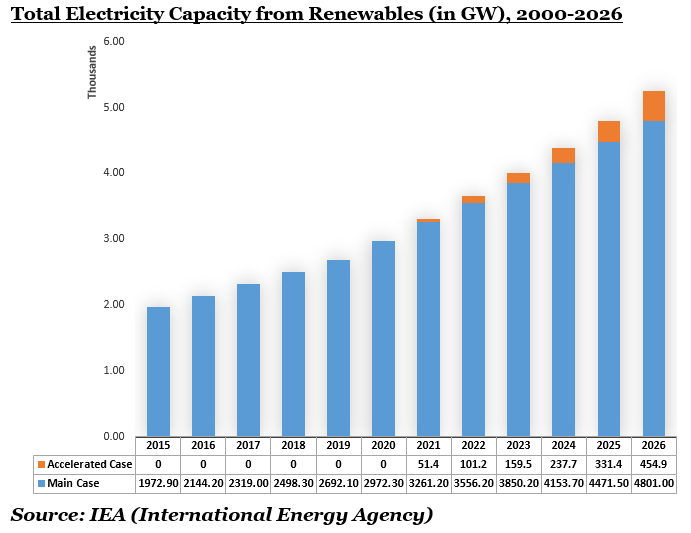

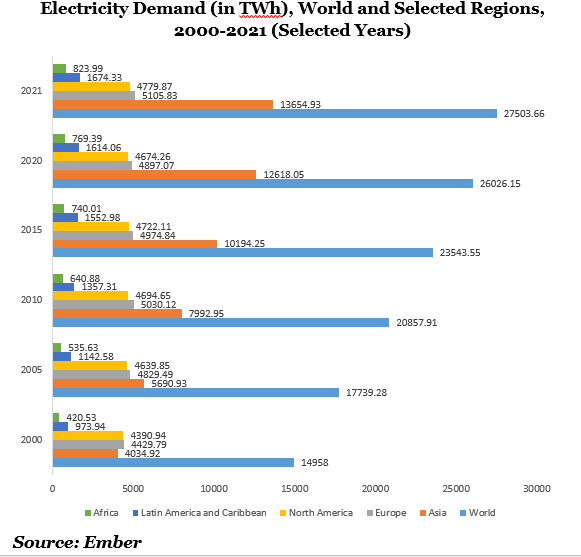

The constant rise in energy requirements globally is expediting large scale adoption of alternative energy sources to adhere to sustainable energy protocols, improving sustainable economy. These developments are significantly improving growth outlook for the global Construction Waste Processing market. According to the Global Energy Review 2021 statistical report, published by the International Energy Agency (IEA), electricity demand surged by 4.5% in the year 2021 on the back of improved economic activities after the dip during COVID-19. Globally, several initiatives and programs on mindful energy consumption and alternative fuel strategies are underway to constantly meet the escalating needs for energy, while also aligning with clean energy protocols.

The United States Environmental Protection Agency (USEPA) coined the Green Power Partnership (GPP) program in 2001 to motivate organizations to voluntarily transition to green power sources for environmental sustainability. After two decades, in 2020 over 700 EPA Green Power Partners were using almost 70 billion kilowatt-hours (kWh) of green power annually which is roughly the annual electricity consumption of over 6.6 million homes in America. These initiatives are expected to kindle growth in the global Construction Waste Processing market in the course of the next decade. As per the data from the US Energy Information Administration's International Energy Outlook 2021 data, energy consumption rate worldwide would increase by 50% in 2050 as compared to 2020 owing to economic growth and population upsurge in non-OECD nations, specifically Asia. Total energy consumption rate in China in 2020 was roughly 5,000,000 metric tons, rising from approximately 4,300,100 in 2015.

The transportation industry is predicted to be approximately worth USD 8 trillion by 2027. Several upcoming factors such as micro-mobility are expected to favor uninterrupted growth outlook for transportation. With urbanization trends setting in, the market value of micro-mobility is expected to become roughly USD 196 billion by 2030. Micro-mobility is emerging as potent substitutes for conventional transport modes as they significantly reduce emissions from fossil-fuel powered transport means. The United States Environmental Protection Agency (USEPA) stated that the greenhouse gas (GHG) emissions from transportation in the United States was 27% in 2020, making it the largest contributor to greenhouse gas emissions. These emissions result from fossil fuel burning in trucks, trains, ships, cars, planes. It is claimed that higher than 90% of the fossil fuels used in transportation is from petroleum including diesel and gasoline. It is therefore observed that several regions globally have resorted to alternative energy sources by transitioning to renewable power generation practices to offset the challenges of GHG emissions leading to environmental degradation. These developments are anticipated to incur favorable growth and ROI in the course of 8-9 years. Further, the rising concern for the surge in energy prices, is also expected to drive the demand for alternative renewable energy sources, which in turn, is expected to drive the growth of the Construction Waste Processing market.

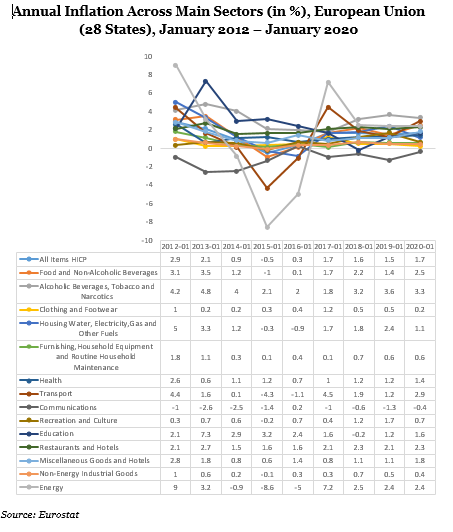

Annual Inflation Across Main Sectors (in %), European Union (28 States), January 2012 – January 2020

This holistic study on the global Construction Waste Processing market incorporates the most recent trends and opportunity mapping, besides the macro-economic factors that are bolstering market growth. Further, the bottom-up and top-down approach to decipher the market numbers besides an intensive segmentation overview and pricing analysis are also compiled in the report. This illustrative report also includes substantial data on Y-o-Y growth rate and absolute $ opportunity value that the global Construction Waste Processing market is expected to incur in 2031 as opposed to 2019.

Top Macro-Economic Indicators Impacting the Growth:

As per the data from International Energy Agency (IEA) total CO2 emissions resulting from energy consumption and industrial processes in 2021 stood at 36.2 Gt, while in 2015 the number was 34.6 Gt. Total energy-related CO2 emissions took a plunge of 6% in 2021, which is recorded as the highest after the resumption of industrial activities following Covid-19 regulations ease. Coal remains the chief source of power for most industrial activities, thus triggering massive CO2 emissions. The data further illustrates that increased CO2 emissions of roughly 2 billion tons superseded the pandemic induced decline. Besides the unprecedented plunge in energy requirements, unfavorable weather conditions and natural gas price volatilities also increased coal consumption significantly. Coal made up for more than 40% of the total CO2 emissions globally in 2021, recording 15.3 billion tons. CO2 from natural gas reached 7.5 billion tons, while from oil consumption, CO2 registered 10.7 billion tons.

Further in the US and Europe, CO2 emissions resulting from electricity production from coal touched 100 million tons. Additionally, China continues to remain the leading contributors to high CO2 emissions, registering 750 million tons between 2019-2021. In 2021 alone, China's CO2 emissions escalated to over 11.9 billion tons, worth 33% of the global CO2 emission count.

Critical steps towards judicious consumption of energy and power in a bid to contract ecological imbalance and restrict reliance on fossil fuels have catapulted significant initiatives on the part of market participants to upgrade their offerings. This has spurred a series of new growth opportunities based on which market players continue to improve their R&D scope and roll out competitive products in the realm of solar recycling equipment and solar panels to collectively inhibit environmental concerns, resulting from prolonged utilization of natural resources and fossil fuels. These developments have propelled industry leaders to align with alternative energy resources, also allowing governments across nations to introduce significant projects to minimize energy waste. Solar photovoltaic deployment has been gaining momentum in the last couple of decades, leading to waste accumulation from decommissioned PV panels, as affirmed by the International Renewable Energy Agency (IRENA). Despite rising challenges to manage PV panel waste, the flip side of the situation is ripe opportunities to cash on new economic possibilities in the coming years. As per the data from IRENA and the International Energy Agency Photovoltaic Power Systems Programme (IEA-PVPS), repurposing of solar PV panels after their full term utilization for 30 years could unwind an average of 78 million tons of raw materials by 2050, re-directing which into the economy could result in profits worth USD 15 billion by 2050.

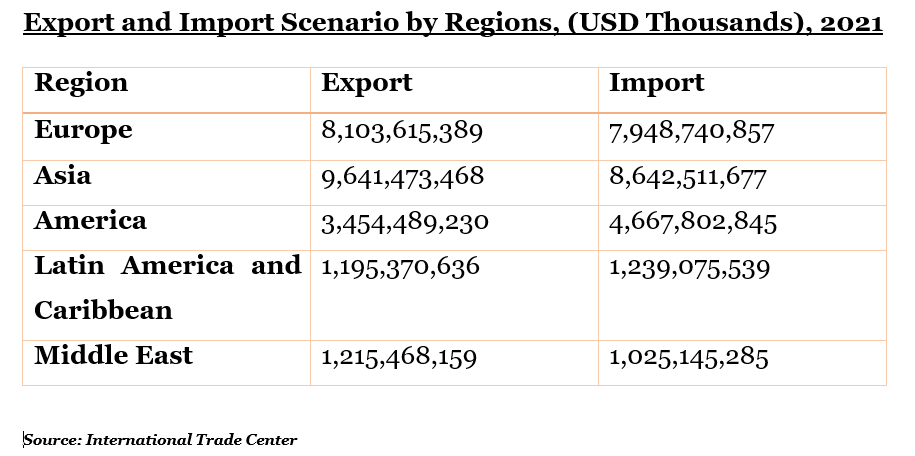

Export and Import Scenario:

Geographic Overview

A separate section in the report highlights regional scenario in market which includes North America (further segregated into U.S. and Canada).

The report further includes a section on European region which is further segmented on a country/regional level including Germany, U.K., France, Italy, Spain, BENELUX, Netherlands, NORDIC, Poland, Hungary, Russia, Turkey, and Rest of Europe.

In the Asia Pacific Construction Waste Processing market, the report studies China, India, South Korea, Indonesia, Malaysia, Japan, Australia, New Zealand and Rest of Asia Pacific. In the Latin America section, an in-depth analysis on Mexico, Brazil, Argentina and Rest of Latin America is covered. Middle East and Africa region have been further identified for the Construction Waste Processing market demand and segregated into Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa and Rest of Middle East and Africa.

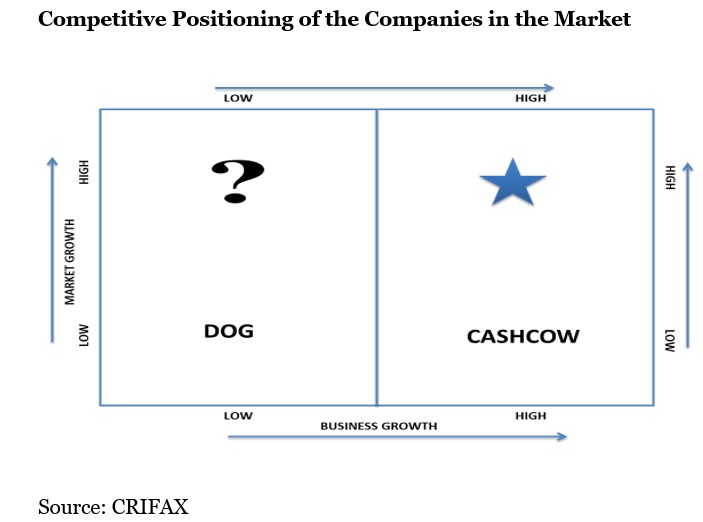

Competitive Landscape

A complete section on competitive landscape provides an understanding of the companies in current strategic report based upon various parameters which includes overview of the company, business strategy, major product offerings, key performance indicators, risk analysis, recent development, regional presence and SWOT analysis. There is a separate section which has been provided on the market share of key players in this market, as well as the competitive positioning of the players.

Note: The above figure is the sample and is used for illustration purpose only

Key Topic Covered

- Market Size, Demand, Y-o-Y Growth Comparison

- Market Segmentation Analysis

- Market Segmentation Analysis by Geography

- North America (U.S. and Canada)

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America)

- Europe (Germany, France, UK, Spain, Italy, BENELUX, NORDIC, Russia, Poland, Turkey, Hungary, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia Pacific)

- Middle East and Africa (GCC, North Africa, South Africa, Rest of Middle East and Africa)

- Absolute $ Opportunity

- Regional Average Pricing Analysis

- Demand and Supply Risk

- Regulatory Landscape

- Regression and Correlation Analysis

- Porters Five Force Model

- Market Dynamics

- Growth Drivers

- Demand Side Drivers

- Supply Side Drivers

- Economy Side Drivers

- Challenges

- Trends

- Opportunities

- Growth Drivers

- Macro-economic Indicators impacting the growth of the market

- Competitive Landscape

- Market Share of the companies

- Competitive Positioning of the companies

- Overview of the companies

- Key Product Offerings

- Business Strategies

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- SWOT Analysis

- Recent Developments

- Regional Presence

Major Target Audience for this report:

- Manufacturers of the product

- Suppliers of raw materials

- Distributors

- Strategic and management consulting firms

- Investors

- Investment banks

- Various regulatory and Government bodies

- Industrial Associations

- Research Organizations and institutes

- Organizations, alliances and forums related to this market

Crucial Questions Answered in this report:

- How the market is going to be impacted based upon the macroeconomic indicators?

- What are the various opportunities in Construction Waste Processing market?

- Which segment and which country has the fastest growth?

- Complete analysis of the competitive landscape

- Where the maximum opportunity lies in terms of further investments by region?

- Potential countries for investment

Scope for the Customization:

We are open for the customization of this report for our client.