Analyzing Impact of COVID-19 on Cloud Supply Chain Management Market

Evaluating Financial Stability During & Post Pandemic

We understand the intense effect of the coronavirus on numerous businesses across the globe, affecting the opportunities, marketing strategies, and pricing models, that are further affecting the growth of the businesses worldwide. We provide updated pointers in this economic pandemic to help the conglomerates to sustain in these uncertain and challenging times and ensure that they take affirmative business decisions. Know More

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2033 with Market Insights.

With the dip in global production, the GDP has contracted in 2022 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2033. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Introduction and Overviews

The global Cloud Supply Chain Management market is expected to grow with a steady CAGR in the coming years. The market growth can majorly be characterized by the surge in the number of technical innovations over the past two decades that has been taking place in the information technology industry. Several industrial and residential applications had been witnessing a boost in the combined use of Internet of Things (IoT) and Artificial Intelligence (AI) technologies, which therefore is projected to drive the growth of the global Cloud Supply Chain Management market over the next decade. Since 2018, the spending on IoT had been increasing by about USD 38 Billion Y-o-Y. Further, in the year 2020, this spending touched close to USD 750 Billion and is further projected to cross USD 1 Trillion by the end of 2022. On the other hand, several end-use industries have been witnessing digital transformation which is also projected to have a positive impact on the growth of the Cloud Supply Chain Management market in the coming years. Further, with the rising adoption of Industry 4.0 and Industry 5.0, the market is poised to touch significant heights in the coming decade. For instance, it is expected that Industry 4.0 could unlock cost-of-quality between 15-25% and also reduce machine downtime by 28-48%. Also, the cost of inventory-holding is expected to reduce by 13-18%.

The global Cloud Supply Chain Management market is also predicted to grow on the back of surge in transformation of business models, supported majorly by the increase in adoption of advanced telecommunication services, such as 5G. It is expected that by the end of 2022, the adoption of 5G would cross 1 Billion. Further, it is expected that a total of over 4060 Million smartphone subscribers of 5G is expected to be recorded by the end of 2027. In addition to this, the increasing share of shipments of 5G enabled smartphones, which is projected to register a share of close to 70% by the end of 2023, is also estimated to contribute to the growth of the market in the coming years. On the basis of region, the leading telecom markets around the globe are spread across the regions of North America, Europe and the Asia Pacific.

We provide a comprehensive analysis of the scope of the market, including the yearly growth of the Cloud Supply Chain Management market by revenues, market segments and gain indicators that are driving the growth of the market. Our report also points out the dominant market trends and opportunities that are available, including market restraints that may impact the growth of the market. The global Cloud Supply Chain Management market is anticipated to register significant absolute $ opportunity value in 20XX as compared to the value attained in 20XX.

The global Cloud Supply Chain Management market study compiles a thorough run-down about plausible business opportunities and risk evaluation outcome by calculating supply and demand risks likely to determine the upcoming growth trajectory of the Cloud Supply Chain Management market. Also, a dedicated portion has been tagged in the report to gauge the co-dependence and regression analysis, underlining the equation between dependent and independent variables. Additionally, the market report also offers readers an impeccable overview of the series of micro and macro-economic factors that maneuver growth probabilities of the global Cloud Supply Chain Management market.

Top Macro-Economic Indicators Impacting the Growth:

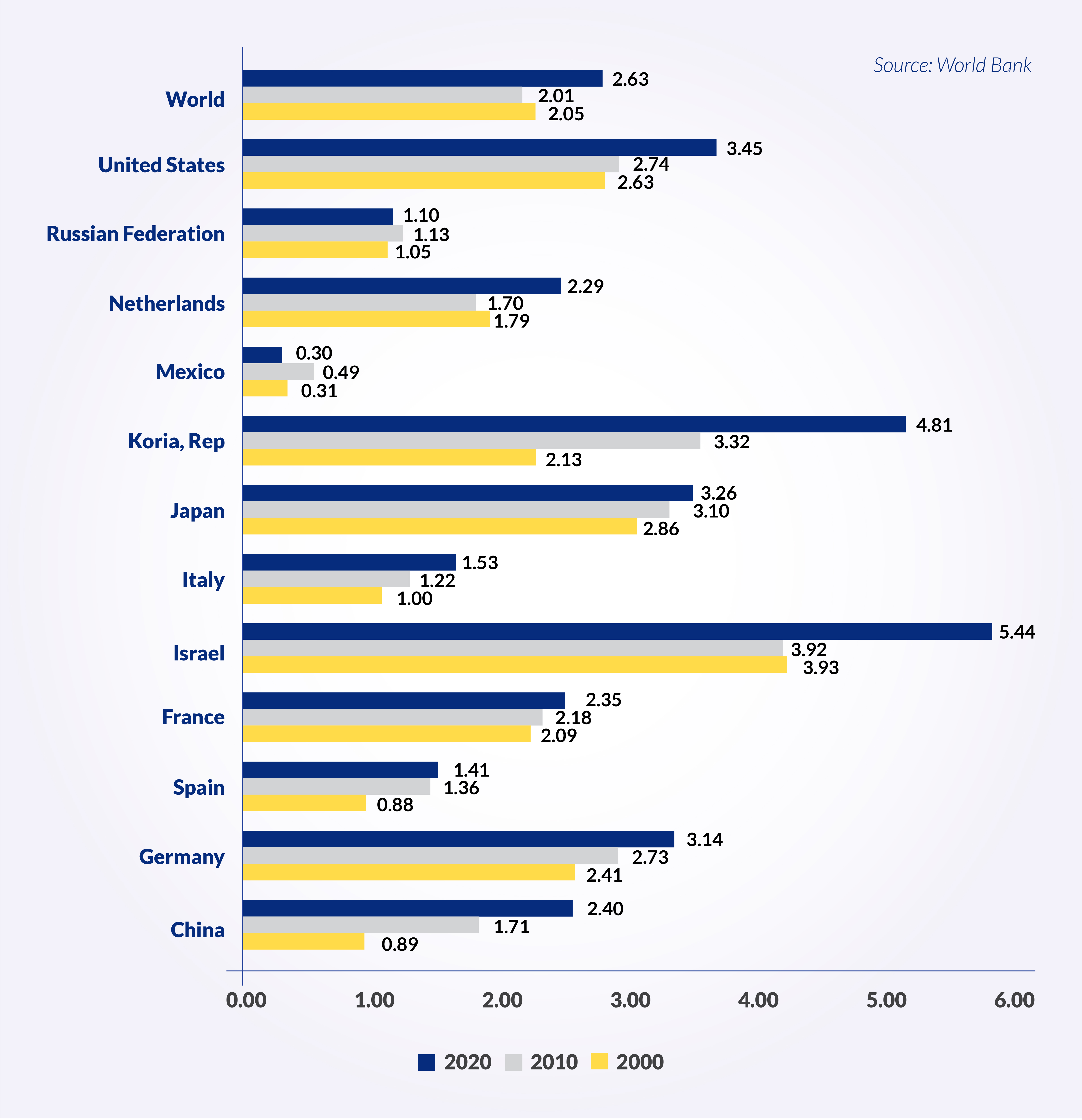

Research and Development Expenditure (% of GDP), Selected Countries and World, 2000-2020 (Selected Years)

One of the other significant factors anticipated to drive the growth of the Cloud Supply Chain Management market is the increasing expenditure on research, which is helping businesses to bring in advanced technological products. For instance, according to the statistics by the World Bank, the research and development expenditure as a share of GDP increased in China and the United States grew from 2.06% and 2.78% respectively in the year 2015 to 2.4% and 3.45% respectively in the year 2020. In addition to this, rising investment by telecom organizations is also projected to add to the growth of the Cloud Supply Chain Management market in the coming years. For instance, the operator capex by telecom operators is projected to cross USD 600 Billion globally by the end of 2025. This would represent about 85% of the share of the investments on 5G as compared to other technology mix.

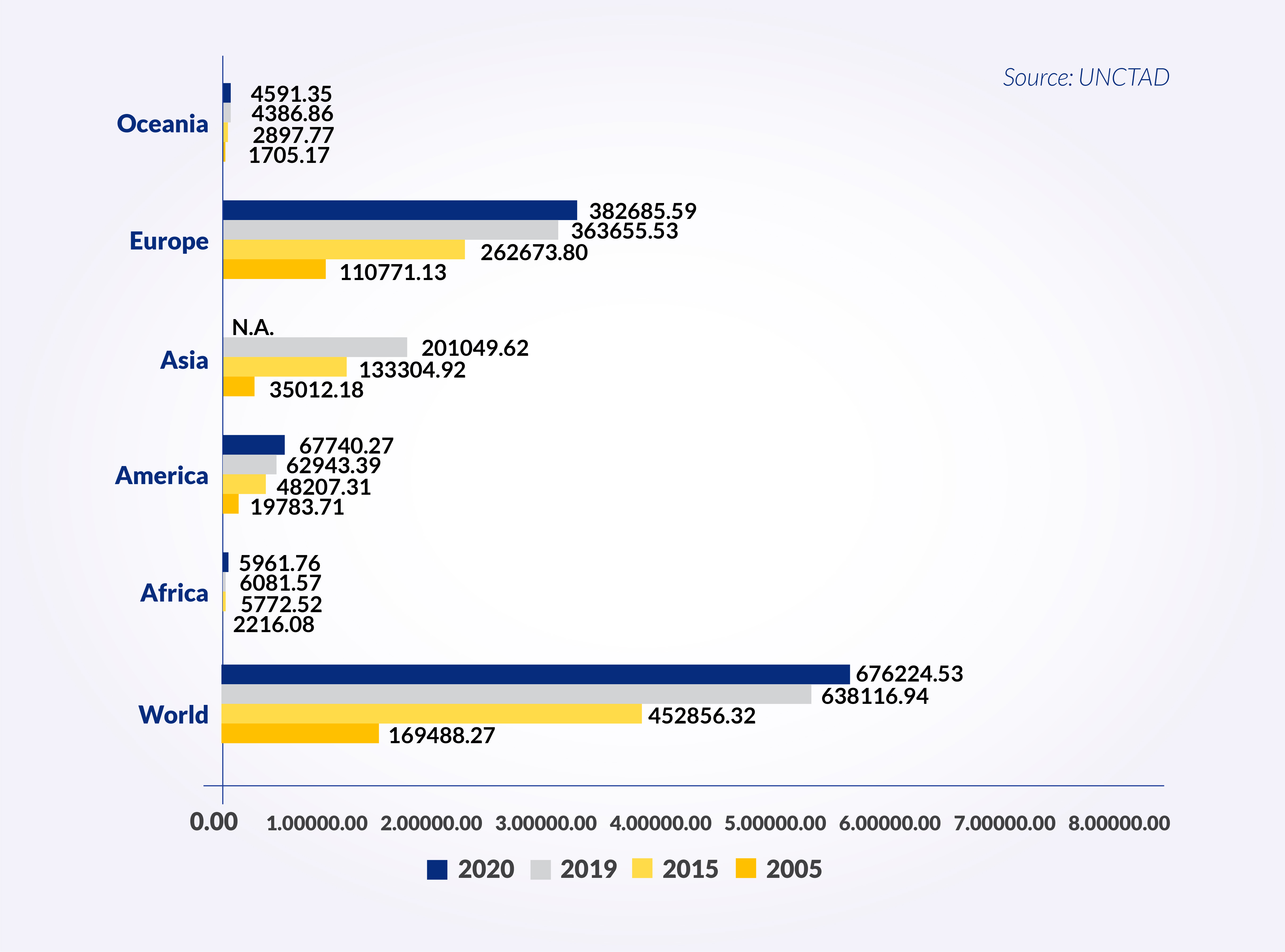

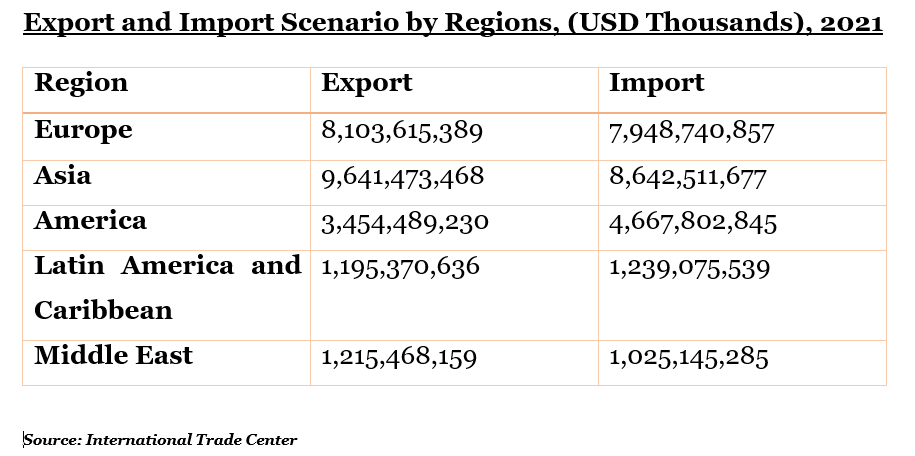

On the other hand, the Cloud Supply Chain Management market is also projected to grow on account of the increasing trade on ICT goods globally. As per the statistics released by the United Nations Conference on Trade & Development (UNCTAD), the share of ICT goods as a percentage of total trade increased from 10.78% in the year 2014 to 14.04% in the year 2020. Amongst these, The Asian region garnered the highest share of 25.77% in the year 2021, followed by Americas with 7.13% in the same year. Further, amongst the Asian sub-regions, Eastern-Asia registered the highest percentage of total trade for ICT goods with 29.80% in the year 2021, followed by South-Eastern Asia with 22.45% in the same year.

Value of International Trade (Exports) in ICT Services, World and Selected Regions (in USD at Current Prices in Millions), 2005-2020 (Selected Years)

Besides this, the growth of the Cloud Supply Chain Management market can also be attributed to the surge in GDP of nations globally, backed by strong economic reforms and supportive policies of the government of nations that are favorable for businesses to expand their offering of their products and services worldwide. In the other statistics by the World Bank, the GDP (PPP) of the world grew from 89.63 Trillion (in current international $) in the year 2010 to 146.71 Trillion in the year 2021. Further, in the United States, China, and Germany, the GDP (PPP) registered in the year 2021 was 23 Trillion (in current international $), 27.31 Trillion, and 4.82 Trillion respectively, which witnessed an increase from 15.05 Trillion, 12.38 Trillion, and 3.19 Trillion respectively in the year 2010.

Export and Import Scenario:

Geographic Overview

A separate section in the report highlights regional scenario in market which includes North America (further segregated into U.S. and Canada).

The report further includes a section on European region which is further segmented on a country/regional level including Germany, U.K., France, Italy, Spain, BENELUX, Netherlands, NORDIC, Poland, Hungary, Russia, Turkey, and Rest of Europe.

In the Asia Pacific Cloud Supply Chain Management market, the report studies China, India, South Korea, Indonesia, Malaysia, Japan, Australia, New Zealand and Rest of Asia Pacific. In the Latin America section, an in-depth analysis on Mexico, Brazil, Argentina and Rest of Latin America is covered. Middle East and Africa region have been further identified for the Cloud Supply Chain Management market demand and segregated into Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa and Rest of Middle East and Africa.

Competitive Landscape

A complete section on competitive landscape provides an understanding of the companies in current strategic report based upon various parameters which includes overview of the company, business strategy, major product offerings, key performance indicators, risk analysis, recent development, regional presence and SWOT analysis. There is a separate section which has been provided on the market share of key players in this market, as well as the competitive positioning of the players.

Note: The above figure is the sample and is used for illustration purpose only

Key Topic Covered

- Market Size, Demand, Y-o-Y Growth Comparison

- Market Segmentation Analysis

- Market Segmentation Analysis by Geography

- North America (U.S. and Canada)

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America)

- Europe (Germany, France, UK, Spain, Italy, BENELUX, NORDIC, Russia, Poland, Turkey, Hungary, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia Pacific)

- Middle East and Africa (GCC, North Africa, South Africa, Rest of Middle East and Africa)

- Absolute $ Opportunity

- Regional Average Pricing Analysis

- Demand and Supply Risk

- Regulatory Landscape

- Regression and Correlation Analysis

- Porters Five Force Model

- Market Dynamics

- Growth Drivers

- Demand Side Drivers

- Supply Side Drivers

- Economy Side Drivers

- Challenges

- Trends

- Opportunities

- Growth Drivers

- Macro-economic Indicators impacting the growth of the market

- Competitive Landscape

- Market Share of the companies

- Competitive Positioning of the companies

- Overview of the companies

- Key Product Offerings

- Business Strategies

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- SWOT Analysis

- Recent Developments

- Regional Presence

Major Target Audience for this report:

- Manufacturers of the product

- Suppliers of raw materials

- Distributors

- Strategic and management consulting firms

- Investors

- Investment banks

- Various regulatory and Government bodies

- Industrial Associations

- Research Organizations and institutes

- Organizations, alliances and forums related to this market

Crucial Questions Answered in this report:

- How the market is going to be impacted based upon the macroeconomic indicators?

- What are the various opportunities in this market?

- Which segment and which country has the fastest growth?

- Complete analysis of the competitive landscape

- Where the maximum opportunity lies in terms of further investments by region?

- Potential countries for investment

Scope for the Customization:

We are open for the customization of this report for our client.